Why You Need a Trademark Insurance Extension

“Laughter is the best medicine, but your insurance only covers chuckles, snickers and giggles.”

We’ve all been there. Whether it’s buying AppleCare or upgrading insurance on your rental car, odds are you feel very strongly about whether additional insurance is worth it or not.

But… if you’ll give us a few moments of your time, we’d like to talk to you about trademark extension insurance. Seriously. We promise to keep this brief and not to call you during dinner, but an “insurance” extension is actually a serious consideration when filing an Intent to Use trademark application, and we really would like to discuss it.

So, what is this “insurance” extension? According to the USPTO, the purpose of an “insurance” extension “is to secure additional time to correct any deficiency in the statement of use that must be corrected before the expiration of the deadline for filing the statement of use.”

In plain English, if you filed a new application as Intent to Use, you must file a Statement of Use once you begin using the applied-for trademark in commerce (i.e. selling stuff). This shows the proof that you are using the trademark for the goods or services (those same ones you said you had an “intent to use” in your trademark application). If you have applied for a trademark before, you know that there is often a somewhat murky line between which specimens (samples showing use) are deemed acceptable and which are not.

An “insurance” extension gives you additional time just in case your specimen is rejected.

Worst case scenario: you apply for a new trademark as Intent to Use. The application is accepted and the USPTO issues a Notice of Allowance, giving you six months to produce and submit a specimen or file an extension request. You file the Statement of Use and the USPTO examining attorney issues an Office Action stating that the specimen submitted does not show use (this can happen for any number of reasons and ultimately relies on the personal judgement of the examiner). You now have six months to respond to the Office Action and submit a new specimen. But here’s the catch. If you take only one thing away from this article, let it be this: even though you have six months to respond to the Office Action, the substitute specimen needs to have been in use prior to the original six-month Notice of Allowance deadline.

Let’s quickly break this down. If you applied for an Intent to Use trademark and a Notice of Allowance was issued on June 14, you would have until December 14, 2019 to submit a Statement of Use with specimen. Let’s say you do this on November 1. But the trademark examiner deems your specimen unacceptable and issues an Office Action on January 23, 2020, giving you until July 23 to submit a substitute specimen. HOWEVER, that specimen must show use prior to the original December 14, 2019 date. If you are unable to produce a substitute specimen showing use prior to that original six-month Notice of Allowance deadline, your trademark application will abandon and you will have to file a new application and risk losing you trademark rights.

This is where the “insurance” extension comes into play, with the potential to save you stress and money. If you are at all unsure about your specimen, you can file a Statement of Use and extension request simultaneously. This will give you an additional six-month safety net if your specimen is rejected.

Going back to our hypothetical timeline: if you filed an extension request in addition to your Statement of Use on November 1, and the trademark examiner issued the same Office Action on January 23, that extension would grant you an additional six month window in which to fix any deficiency with the specimen.

Filing an “insurance” extension as a contingency plan is a fraction of the cost of filing a new application. The trademark department at Drumm Law will do whatever we can to make sure that the specimen you provide for the Statement of Use will be accepted, but it is impossible to know what the many attorneys at the USPTO will accept and what they will reject. Give yourself some time.

Email us at trademark@drummlaw.com and we would be glad to review the specimen you intend to use and, if you think it’s appropriate, talk to us about filing an “insurance” extension. The last thing we want is for you to waste money because your specimen was rejected.

** It should be noted that you are only allowed to file one insurance extension, even if you have not met your 36-month extension limit.

How to Avoid Trademark Scams

We have been trying to reach you about your car’s extended warranty…. a member of the royal family would like to transfer a large amount of money to you…. your Netflix password has been compromised, reset now… Does this sound familiar? Well now you can add another to the list. Harmful phishing schemes are everywhere these days and scams, or spam, that specifically target trademark holders are rising steadily. According to 2019 data, about 45% of the world’s daily email traffic is spam – that’s somewhere in the neighborhood of 14.5 billion spam emails globally every day. Add to these extraordinary numbers the ubiquity of mail fraud and you have a tricky landscape to navigate.

Misleading invoices demanding astronomical sums of money to secure your trademark on a private registry or to file a trademark renewal on your behalf are favored as vehicles to defraud trademark owners. If you have ever registered a trademark with the United States Patent and Trademark Office (USPTO) (or internationally with the World Intellectual Property Organization (WIPO) or European Union Intellectual Property Office (EUIPO)), you are at risk of receiving fraudulent renewal notices, cancellation threats, or revival offers. Chances are you have already received at least one.

Because registrants’ addresses are publicly available, such solicitations used to come most commonly through the mail. These are no less alarming than the emailed variety, but easier to ignore in the digital age. That all changed at the start of 2020 however, when the USPTO instituted a new policy of requiring email addresses for the owner of an application. This rule was eventually amended some months later to not show the owner email address on the public record, so long as an attorney email is present. But this means that, for a several month period, owner email addresses were vulnerable public information, available at the fingertips of anyone with a computer, scammers included.

Whether it’s coming via inbox or mailbox, trademark scams are prolific. Any notice not originating from the United States Patent and Trademark Office, or your trademark attorney, should be treated as a scam. So, what can you do to keep yourself safe? Whether you are a Drumm Law client or just stopping by to read this article, if you think you have received a scam letter or email please contact us at trademark@drummlaw.com. We are more than happy to help you determine if the letter is real or fake.

Here are a few additional tools you can use to help mitigate the risks of falling victim to a trademark scam:

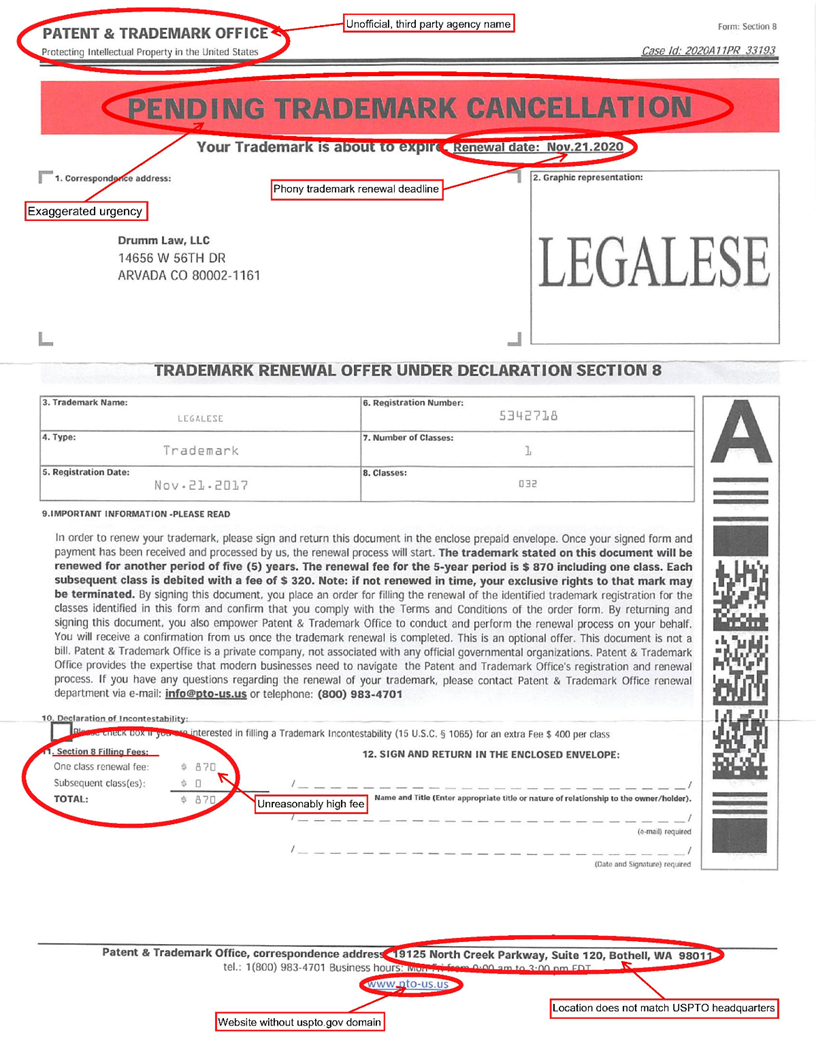

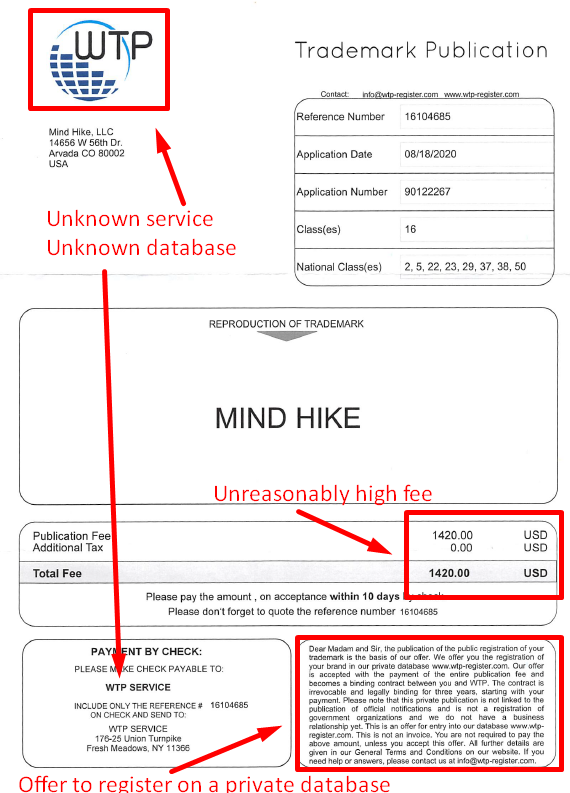

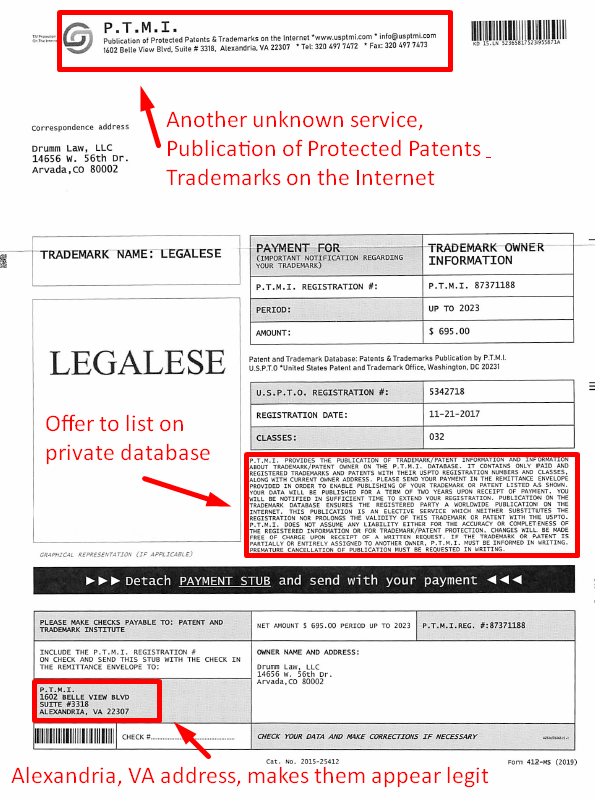

- Know what to look for. Unlike everyone’s favorite Nigerian prince, trademark scams are often subtle. You may receive notices that look legitimate, even to a discerning eye. Organizations like “Patent and Trademark Office,” “PTMI – Register of Protected Patents and Trademarks,” or “Trademark Compliance Center” all sound official at first pass, but don’t be fooled. Such titles will often be accompanied by a fictitious seal or a passably governmental web address.

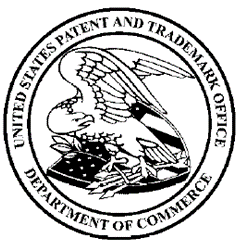

Official letterhead of the United States Patent and Trademark Office:

Official seal of the United States Patent and Trademark Office:

Official seal of the United States Patent and Trademark Office:

Bottom Line: if it’s not from the United States Patent and Trademark Office in Alexandria, VA or the domain uspto.gov, it’s probably spam.

Bottom Line: if it’s not from the United States Patent and Trademark Office in Alexandria, VA or the domain uspto.gov, it’s probably spam.

- Know your trademark. Many trademark scams rely on a sense of urgency and provoke panic over losing your trademark rights. They will often feature headings - or a note on the envelope -such as “URGENT – open immediately!” or “Cancellation Notice.” These are frequently accompanied by either inaccurate or partially accurate renewal dates. The goal is for a recipient to make a knee-jerk payment for fear that their trademark will expire right under their nose. In reality, the USPTO offers a yearlong window for trademark renewal and a six-month grace period during which a renewal can still be filed with a late fee. Knowing what your real deadlines are can go a long way in weeding out spam surrounding your trademarks. If your trademark attorney isn’t giving you a heads-up about when your trademark is open for renewal, find an attorney that does. Send us a message; we will let you know if you have a deadline coming up.

Bottom Line: if a notice comes as a surprise, demanding immediate action for a rapidly approaching deadline, it’s probably spam.

- Know what to pay. While most law firms and online DIY services charge filing fees in varying amounts, many scams push the boundaries of what is believable pricing. The USPTO provides more useful information on trademark fees and how they are assessed here: https://www.uspto.gov/trademark/trademark-fee-information

Bottom Line: If you receive a notice requesting $800, $900, or $1,000+ for the renewal of one trademark in a single class, this is good reason for skepticism.

Not even an intellectual property law firm like ours is immune to deceptive solicitations. Below are three examples of recent scam letters we received. We have highlighted major red flags you should be on the lookout for.

Ultimately, the best defense against scams is hiring a trademark attorney – this will ensure that all updates and notifications from the USPTO will be funneled through them. They can help you remain vigilant against phony solicitations and offer valuable advice in other trademark matters, saving you money and stress in the long run.

10 Work From Home Tips to Increase Productivity

Drumm Law and its team of 24 have been working remotely for 10 years. Here are some tips for the newly virtual.

- Get out of bed (literally and figuratively)

Do not lay in bed with the laptop. That is fine for weekend/evening work but not for day to day. Get out of your pajamas. There is a psychological component (for me at least) about getting dressed and ready for work and working. - Setup a work area

Ideally, you need a separate place, whether it is a guest room, separate office or basement. If you have younger kids, a room with a door lock can help (my kids would randomly show up in the middle of a conference call before I had installed a lock on the door and two year olds rarely leave quietly). If you do not have access to a separate work area, use technology to create a “virtual work area.” Noise cancelling headphones are key! (I recommend either the Bose QC 35 or Bose QC 700)This commercial sums up why I love my noise cancelling headphones when I work from home:

https://www.youtube.com/watch?v=VqYK9W2A53s - Set up a workstation

Your laptop may have worked for weekend work but will it work for your daily workload? Do you need a bigger monitor? Are you a dual monitor addict? Set yourself up to be productive. Have everything you need in one place. - Set a work schedule

Avoid the “Am I always at home or am I always working” mentality by planning each day (this is also a productivity hack too). Set your work day and breaks. It’s okay if it changes. - Communicate with your family

Let them know your break schedules. Have them treat you like you are at work (text me as opposed to coming into my work area). - Stay away from the fridge

You are in a new “work” environment with new “work” food. Limit your snack visits to avoid the Virtual Freshman 15. - People should only know you are working from home if you tell them

Don’t have dogs barking in the background or the television on. This may also tie back to communication with the family. Let them know if you have an important call or if they need to be extra quiet. - Be careful of scammers

They are also working from home. Make sure you have anti-virus protection. Don’t open emails that look suspicious. Now might be a good time to update passwords. - Get work done

It’s easy to get distracted with news, social media and life. Try to be as productive as you can. Don’t put off work unless you have to. Try to do “business as usual” as much as you can. - Take breaks

Do you normally take a lunch break every day? If so, continue to do it. Use the time you would have spent commuting to the office each day to take a walk or exercise.

How to Find Franchise Disclosure Documents Online for Free

There are four states that publish FDDs online.

California

https://docqnet.dfpi.ca.gov/search/

California’s search engine is slow to update, but every document associated with a franchise registration (FDDs, blacklines, applications, permits) is available on the site, once they get around to updating it. Sometimes you have to know the exact name of the franchisor to be able to find the filing.

Indiana

https://securities.sos.in.gov/public-portfolio-search/

Clean and easy to use, but they just started the site in 2019, so only 2019 current registrations are available.

Minnesota

https://www.cards.commerce.state.mn.us/

Be sure to add a year, or it will pull up every registration ever made. Able to search by franchisor or franchise offered.

Wisconsin

https://www.wdfi.org/apps/FranchiseSearch/MainSearch.aspx

Simple to use if the franchisor is registered there. Able to search by name of Franchisor or name of franchise.

What is a Trademark Disclaimer?

A disclaimer is a statement that indicates that the applicant does not have the exclusive right to use a specific word of a trademark by itself.

Disclaimers are required for composite trademarks (English translation=trademarks with more than one word or design marks with separate elements) for the portion of the trademark that is merely descriptive, generic, or geographic or it contains a company designation or a well-known symbol such as the dollar sign ($). The disclaimer statement indicates that the applicant does not have the exclusive right to use that specific word of the trademark when standing alone. The exclusive trademark rights exist in the entire mark. The reasoning for disclaimers is that these types of words and/or symbols are needed by other people and businesses to describe their goods and/or services. So no one gets to claim exclusive rights to these terms.

For example, if you tried to register a beer named Legalese IPA, you would probably have to disclaim the exclusive rights to “IPA”. The IPA element is descriptive and un-registerable by itself. While you would be able to stop other breweries from naming their beers Legalese Stout, you are not able to stop anyone from calling a beer an IPA.

Here are some famous examples of disclaimers:

STARBUCKS COFFEE – No claim is made to the exclusive right to use “coffee” apart from the mark as shown.

KIA MOTORS – No claim is made to the exclusive right to use “motors” apart from the mark as shown.

BURGER KING – No claim is made to the exclusive right to use “burger” apart from the mark as shown.

Trademark State Registration

I don’t distribute my goods out of state. Can I still trademark my names?

The short answer is YES!

The Lanham Act (also known as the Trademark Act of 1946) is the federal statute that governs trademarks. Generally, the Lanham Act requires that a mark is used in interstate commerce before it may be registered as a federal trademark.

Thankfully, interstate commerce is broadly defined.

Traditionally, interstate commerce has been focused on whether or not goods have physically crossed state lines. Due to the nature of modern commerce, travel, and the expanding reach of the internet, the lines for what is truly “local” has changed over the years.

“Use in Commerce” Within a State

Adidas (the shoe and apparel company) tried to trademark “ADIZERO” for athletic apparel (fun fact-one of the founding brothers of Adidas broke off and formed the shoe company Puma). The Trademark Office blocked this trademark because of a likelihood of confusion with the trademark “ADD A ZERO,” which was a clothing trademark owned by a church in Illinois for its fundraising campaign to encourage its congregants to add a zero to their donations (as in don’t give $10, give $100).

Adidas argued that the church’s marks were not in interstate commerce. The Illinois church defended the alleged non-use in interstate commerce argument by offering evidence that it had sold two hats bearing the contested marks to a parishioner who resided across state lines in Wisconsin. The sale occurred within Illinois, so the church did not rely on a sale made to a customer located across state lines at the time of the purchase. Adidas argued that the sale of two hats were “De Minimis,” meaning too trivial or minor to merit consideration for interstate commerce. Adidas won at the trademark court and the decision was appealed.

The Federal Circuit on appeal clarified the broad protection of the Lanham Act and reversed the trademark court holding. The Federal Circuit stated that the Lanham Act defines interstate commerce as all commerce which may lawfully be regulated by Congress.

The Federal Circuit held on appeal that the church’s sale of two hats showed that the marks were used in interstate commerce for Lanham Act purposes. The Federal Circuit Court held that the church was not required to present evidence that its sale of hats actually affected interstate commerce, or even to show that the hats were destined to cross state lines. Rather, the church merely needed to show that its sale activity, even if just local, fell “within a category of conduct that, in the aggregate” could exert a substantial effect on interstate commerce.

Say That Again Please (In English)

You make goods. Your goods are offered for sale. Out of state people may purchase said goods at your retail location or other locales. These purchases in the aggregate can affect interstate commerce.

Helpful Tips

Because the law (or the courts’ interpretation of the law) can change, here are some practical tips to ensure that you have interstate commerce goods:

- When you release new goods, make sure to get it on the worldwide web (whether through your own website or through the various social media channels).

- Encourage your guests to review your goods on the various review websites (odds are good you will have plenty of out of state reviews).

Clothing Trademarks

Ornamental Refusal? Wait… what?

Is your apparel graphic a “brand identifier” or just decoration? An ornamental refusal is when the USPTO refuses registration of your trademark because the specimen submitted with your application shows the use of your mark merely as an “ornamental” or decorative use on the goods and not as a trademark to indicate the source of the goods.

Trademarks are used to identify a product’s origin and tell you a bit about it - usually who made the product and a certain level of quality. In order to file a trademark for apparel, you must be using the proposed wording or design to identify that clothing as belonging to the trademarked brand, not just as embellishment. Logos, slogans, or branding that are exclusively decorative do not identify and distinguish goods and do not act as a trademark.

For example: a Ford logo can be used to identify a Ford truck. But that same logo on a t-shirt does not identify it as a brand of clothing (failing to indicate, for instance, quality, country of origin, etc.). Instead, this logo is being used as a decoration to appeal to people that like the Ford brand.

On the other hand, a polo shirt featuring the Lacoste crocodile on the breast creates the impression of a trademark - identifying the brand as that of the French clothing company Lacoste.

On the other hand, a polo shirt featuring the Lacoste crocodile on the breast creates the impression of a trademark - identifying the brand as that of the French clothing company Lacoste.

3 Ways to Secure Your Initial Franchise Fees

To defer, or not to defer, that is the question. A blog on state registration financial assurance options.

As most franchisors know, there are 14 states that require a registration of the Franchise Disclosure Document (“FDD”). Of these 14, nine states will review the franchisor’s financial statements and impose financial assurance requirements if the franchisor’s financial health is not up to their standards. These financial reviewing states are:

California, Hawaii, Illinois, Maryland, Minnesota, North Dakota, South Dakota, Virginia and Washington.

(*New York reviews the financial statements, if they are concerned about the financial condition of the franchisor, they require a risk factor to be listed on the state cover page instead of financial assurances.)

Virginia is the only state of the nine to provide clear guidance on when financial assurances are required (when the franchisor’s liabilities exceed their assets). For the rest of the states, there is no bright line requirement and it will depend on examiner discretion. Generally, a state examiner looks at the franchisor’s equity position, working capital, debt levels, and profits. If a franchisor doesn’t satisfy a state’s criteria, it will be required to provide a financial assurance.

There are generally five ways to satisfy a state’s financial assurance requirement: (1) escrow initial franchise fees, (2) defer initial franchise fees, (3) purchase a surety bond, (4) infuse additional capital, or (5) obtain a guarantee of performance.

Because most franchisors are usually unable to infuse additional capital (which comes with strict requirements about how long the money must remain in the account) or obtain a guarantee from a parent or affiliate (which requires audited financials from the parent or affiliate), we will discuss the three common choices (escrow, defer or bond).

3 Common Choices for Satisfying Franchise Financial Assurance Requirements

1. Escrow initial franchise fees:

All registration states allow franchisors to set up an escrow account where initial franchise fees are deposited. Initial franchise fees include any fee that would be collected prior to opening, and includes the cost of required purchases of products and services from the franchisor. Franchisors are often required to use a financial institution from the state in which the fees will be collected, and the franchisor must execute an escrow agreement using forms provided by each state. Funds can’t be distributed until the franchisor has fulfilled its pre-opening obligations—like training and site selection assistance—and the franchise is open for business. The state must also provide written authorization to the financial institution before funds are disbursed.

2. Defer initial franchise fees:

This is the most popular option (also the only free option). Registration states may allow franchisors to defer collection of all initial franchise fees until pre-opening obligations are fulfilled and the franchise is open for business.

3. Surety bond:

The last alternative is to post a surety bond that covers or exceeds the initial franchise fees that will be collected in the state during the upcoming 12 months. Some states require an amount equal to the initial franchise fees multiplied by the estimated number of franchises to be sold in the state during the next 12 months, while others require a flat amount (e.g. $100k). In either case, the total dollar amount of the initial fees collected must not exceed the amount of the surety bond (you may have to increase the bond if you sell enough franchises). Many states provide form surety bond agreements. Surety bonds may be expensive and often require a personal guarantee from the franchisor.

Below is a summary of the advantages and disadvantages of each financial assurance option:

|

Form of Financial Assurance |

Advantages |

Disadvantages |

|

Escrow Initial Fees |

The franchisee has “skin in the game” by paying out the initial franchise fees Payment is assured as long as franchisee opens and franchisor’s pre-opening obligations are met Less expensive than a surety bond |

Involves ongoing administrative burden (you have to submit paperwork signed by the bank, the franchisee and franchisor to the state to get approval to release the funds- which may take days or weeks) Often difficult to find in-state banks that will provide the service Can be expensive (legal and banking fees) Funds cannot be accessed until franchisor’s pre-opening obligations are met and franchise is open for business |

|

Defer Initial Fees |

The only option that is “free” and involves no forms or agreements Very low administrative burden Doesn’t rely on or involve affiliate’s or parent’s financial condition |

Initial franchise fees cannot be collected until franchisor’s pre-opening obligations are met and franchise is open for business Franchisee gets trained and gains access to confidential information without paying any initial franchise fees up front The franchisee does not has “skin in the game” by paying out the initial franchise fees You will have to sue to get the fees if the franchisee fails to open |

|

Surety Bond |

Initial franchise fees may be collected and used immediately upon signing Lower administrative burden than escrow |

May be very expensive May require personal guarantee Involves greater administrative burden than fee deferral or guarantee Bond may need to be increased throughout the year |

Non-Solicitation Provision In Franchising: Explained

What is a non-solicitation provision?

A non-solicitation provision is an agreement that prohibits franchisees from lobbying or taking any employees from the franchisor or other franchisees. It’s also called a “no-poaching” provision.

Why do franchise agreements have non-solicitation provisions?

Each franchise system is unique, and it takes time to train employees to do things the “system-way.” The more you invest in a worker, the more valuable that worker becomes. Unfortunately, that value makes a worker a potential target for poaching by another franchisee or former franchisee.

Talent-poaching is disruptive and leads to contention within a franchise system. Non-solicitation provisions help maintain system harmony and protect talent investment by prohibiting a current or former franchisee from lobbying or hiring a system-franchisee’s or franchisor’s employees.

Why would I ever remove non-solicitation provisions from my franchise agreement?

Attorney General Offices in California, District of Columbia, Illinois, Massachusetts, Maryland, Minnesota, New Jersey, New York, Oregon, Pennsylvania, Rhode Island and Washington believe that non-solicitation provisions are anti-competitive. Massachusetts Attorney General Maura Healey said in a July 9, 2018 press conference that, “No-poach agreements unfairly limit the freedom of fast-food and other low-wage workers to seek promotions and earn a better living. Our goal through this action is to reduce barriers and empower workers to secure better-paying and higher-skill jobs.”1

Franchisors with non-solicitation provisions may be at risk of administrative action alleging that their no-poaching provisions unlawfully restrains trade. There’s also a potential for class action plaintiff lawyers to jump on the band wagon, taking the position that these provisions oppress a class of similarly-situated workers.

The focus by the states is largely aimed at quick-serve and fast food industries, where wages tend to be lower and the impact could be more severe on franchise employees, but the effects are likely to be seen in the wider franchising industry as well.

What are my options?

It’s difficult to make an informed decision when the issue is still unsettled and developing. Until things are more settled, we see three options:

– Wait to take action until the issue is settled. We think this is a risky approach given the uncertainties in how these investigations will proceed and the potential penalties for franchise systems that still have non-solicitation provisions when new laws or regulations are ready.

– Remove non-solicitation provisions now, or at the next opportunity (e.g. renewal). We recommend this approach. While non-solicitation provisions may serve a valuable function in maintaining system goodwill among franchisees, we believe the potential administrative, civil, and potentially criminal liability outweighs those benefits.

– A third alternative is to remove non-solicitation provisions and update the operations manual to encourage non-solicitation as a “best practice,” rather than a contractual requirement. While there would be no legal recourse against a franchisee, it may at least establish a culture to discourage the practice.

Notes:

1 https://www.mass.gov/news/ag-healey-leads-multistate-investigation-of-worker-no-poach-agreements-at-national-fast-food (last viewed July 27, 2018).