Can You Trademark AI-Generated Images? Understanding Your Rights

Can You Trademark AI-Generated Images? Understanding Your Rights

In today’s digital world, creating a logo is just a click away. AI tools have revolutionized how business owners approach design, offering custom logos in minutes. But here’s the burning question: Can you actually trademark an AI-generated image? The answer isn’t as straightforward as you might think.

Understanding Ownership of AI-Generated Art

When it comes to AI-created designs, ownership becomes complicated. Unlike traditional artwork where human creators hold clear rights, AI-generated images exist in a legal gray area. According to the U.S. Patent and Trademark Office guidelines, trademark protection requires unique elements that distinguish your brand in the marketplace. With AI-generated content, establishing this uniqueness can be challenging.

Here’s what you need to know about AI image ownership:

- AI tools may claim ownership through their terms of service

- The role of human input affects legal protection

- Current legal frameworks are still adapting to AI-created content

Navigating Trademark Applications for AI Logos

The trademark application process for AI-generated logos requires careful consideration. Your design must be:

- Original and distinctive

- Different from existing trademarks

- Created with clear ownership rights

One significant challenge is that AI systems are trained on vast databases of images. This means your AI-generated logo might inadvertently incorporate elements from existing designs, potentially complicating your trademark application.

Common Challenges with AI-Generated Logos

Business owners often face several hurdles when trying to trademark AI-generated images:

- Limited control over the final design output

- Potential copyright conflicts with training data

- Ownership disputes with AI platform providers

- Difficulty proving originality

Protecting Your AI-Generated Brand Assets

Want to strengthen your chances of successfully trademarking an AI-created logo? Consider these steps:

- 1. Review AI Platform Terms

- Read the fine print carefully

- Understand who owns the output

- Check for any usage restrictions

- 2. Customize Your Design

- Add unique brand elements

- Modify colors and typography

- Include distinctive features

- 3. Document Everything

- Save all versions of your design

- Record modifications made

- Keep platform usage records

Best Practices for Filing Trademark Applications

Before submitting your trademark application for an AI-generated image, ensure you:

- Document all modifications made to the original AI design

- Verify ownership rights with the AI platform

- Conduct thorough trademark searches

- Consider working with a trademark attorney

Working with Legal Professionals

Partner with trademark attorneys who understand the intersection of AI and intellectual property law. Their expertise can help navigate:

- Complex ownership questions

- Trademark application requirements

- Potential legal challenges

Moving Forward with Your AI-Generated Logo

While trademarking AI-generated images presents unique challenges, it’s not impossible. The key is understanding your rights and taking proper precautions from the start. By following best practices and working with legal professionals, you can better protect your AI-created brand assets.

Remember, your logo is more than just an image – it’s a vital part of your brand identity. Taking the time to properly protect it through trademark registration can save you from potential legal headaches down the road.

Ready to protect your AI-generated logo? Consider consulting with a trademark professional to understand your options and secure your brand’s future.

Note: This article is for informational purposes only and should not be considered legal advice. Always consult with a qualified legal professional for specific guidance regarding your situation.

Put Your Best Mark Forward: Why It’s Smart to File A Word Trademark First

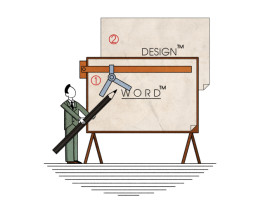

As a business owner, protecting your company’s intellectual property is of paramount importance. Trademarking your names and logos can go a long way in safeguarding your brand identity. In a perfect world, we would all have the resources to immediately file applications for each and every brand-identifying element right at the launch of any business venture. Unfortunately, we live in the real world, where resources are not always available all at once and prioritizing is key. The question this very real set of circumstances often brings with it is “do I file for my name or logo first?” While both play important roles in characterizing your business, the answer, in most cases, is to file for a standard word mark before proceeding with a trademark application for your logo. Here’s why:

1. Flexibility of Use

A “standard word mark” is a trademark that protects your brand name itself. It does not matter how the words are stylized, what font or color is used, or if they are featured in conjunction with artwork, so long as the words (and punctuation, if applicable) remain the same. Once this trademark registers, the name is protected.

A design mark, on the other hand, protects the specific design elements as submitted, including the stylization of the text and any images or graphics. If you change the design of your logo (even in small ways, like adding or removing elements or updating the layout), protection conferred by a registered logo trademark becomes irrelevant, as you are using a different, unregistered design. Without use, the previously registered trademark can be considered abandoned.

Particularly in the early days of a business, or in the initial stages of a rebrand, the logo you start with might not be the logo you ultimately wind up using in commerce. Therefore, prioritizing your word mark, and filing a trademark application for this first, offers brand protection while allowing flexibility for future design changes.

2. Broad Protection

Word marks simply offer a broader range of protection than design marks. While visual branding is invaluable, and you certainly want to protect your logos, if you only have a design mark, your scope of protection is limited. Even if your logo features your brand or product name, without a standard word mark, you have not protected the name by itself. Competitors could potentially use the same or similar words in their branding. If you have a word mark, no one else can use it, regardless of the design, font, or color they use – doing so would be infringement on your trademark rights.

3. Cost Efficiency

Trademarks are a cornerstone of any business’s IP portfolio and integral to most marketing strategies, but the process of trademark registration can be costly and time-consuming. Therefore, it is sometimes necessary to be strategic in how and when you allocate funds for new applications. Presumably, the name of your business or flagship brand will remain the same, if not forever, for a very long time. Logos, on the other hand, can sometimes be more fluid. Rebrands happen, and this potential eventuality should not deter you from registering a design you plan to use for an extended period. However, if you aren’t fully committed to one version of a design and need to file a new application with every iteration, the costs can quickly add up. Until you have decided on a permanent logo, a standard word mark can do a lot of heavy lifting on the trademark front.

4. Easier Enforcement

Part of trademark maintenance is remaining vigilant about enforcing your trademark rights. This means keeping an eye out for other users infringing on your trademarks and either reaching out to these unauthorized users directly or consulting with legal counsel to do so. But trademark enforcement can be tricky when there is any room for interpretation and enforcing a word mark can be easier than a design mark since it focuses on something more concrete (specific words in a specific order for a specific thing). Unauthorized use of a similar logo can sometimes be skirted by arguing minor differences in composition or layout. A word mark is less open to interpretation, and can thus be more straightforward to enforce, something you want when it comes to your primary brand. Focusing on – and enforcing – a word trademark can also help bolster your ability to enforce future design marks that incorporate your name.

While both word and design marks are important components of any brand’s trademark strategy, there are clear advantages to prioritizing the registration of your word mark. This initial step provides flexibility for future logo changes, broad protection against potential infringements, cost efficiency in filing, and an easier path to trademark enforcement. Once a standard word mark is secured, you can look ahead to fleshing out your trademark portfolio from a relatively secure vantage point, ensuring robust and well-rounded protection for your brand.