Trademark vs. Copyright: What's the Difference

When creating a new product or service, or even forming a new entity, understanding the differences between trademarks and copyrights can be vital.

The first step is really a simple one: it’s important to find the right trademark lawyer for you. At Drumm Law, we’re proud to offer attorneys with expertise in the area of trademarks. We work with all of our clients to help them efficiently, and cost-effectively, setup their businesses and position them to be the most successful versions of themselves.

“A lot of times, (people) misuse the word copyright, like ‘I want to copyright my brand,’” said Mike Drumm, attorney and founder of Drumm Law. “One of the most clever sayings in the world is “I want to protect (my brand). A trademark protects a brand, copyright protects you from copying a product like music or a book.”

In short, the difference between trademarks and copyrights, although seemingly confusing, can be simply conveyed as this: trademarks protect commercial names, phrases and logos (i.e. the name of your beer and the logo of your company). Copyrights generally protect creative works (i.e. the design of the label on your beer). While both may be important, it’s the trademarks that are of the utmost importance for breweries.

“Trademark is, ‘I have a brand and you can’t have a brand that looks like mine,’ but copyrighting is protecting something you created — not the idea,” Drumm added.

About Drumm Law

At Drumm Law, we offer an experienced team of trademark attorneys, proficient in helping our clients:

- Select and file proper trademark applications

- Undergo trademark clearance searches

- Defend/file trademark application prosecution

- Monitor trademark usage and maintenance

- Conduct intellectual property audits

- And more…

Contact Drumm Law’s trademark lawyers to receive help with your trademarking processes at.

What does a franchise lawyer do?

When deciding to embark on franchising your business, or franchising a new business, gathering all of the information needed before making the important decision of hiring a franchise attorney is important.

Sometimes, however, it can be confusing as to why you need a franchise lawyer, or what exactly the benefits are of having one. So, what does a franchise attorney actually do?

In short, a franchise agreement is a massive commitment. A relationship between a franchisee and franchisor can be a 20+ year relationship that may require an initial investment of tens, if not hundreds of thousands of dollars.

As with any financial agreement, a franchising agreement comes with mountains of paperwork and liability disclaimers — often exceeding 50 pages.

The Franchise Disclosure Document (FDD), a legal document that must be given to individuals that are interested in buying a U.S.-based franchise as part of the pre-sale “due diligence” process, generally totals 200+ pages.

The Federal Trade Commission (FTC) created these guidelines in 1978 that required franchisors to share information prior to allowing a new franchisee to join their business.

Learn more about Franchise Disclosure Documents.

About Drumm Law

At Drumm Law, our mission is simple — we are a virtual firm with an award-winning team of franchise attorneys that are ready and willing to assist you with any of your legal franchise needs.

Contact one of our franchise lawyers today to get legal help with your franchise.

Learn more about franchising your business here.

Why Do I Need a Franchise Attorney?

When you’ve finally decided to start the process of potentially franchising your business, there’s a lot to consider. From contemplating potential franchisees to understanding the proper documents and protection needed for your business, the franchising process can sometimes feel more daunting than it needs to be.

But before you decide to franchise your business, you need to start by finding a franchise lawyer or attorney that not only knows your industry — but knows franchising inside-out.

Business entity advice

A competent franchise attorney can offer you incredibly useful suggestions how to structure your new or existing franchise business. When it comes to selection entity types, there are a variety of options: Limited Liability Corporation (LLC), Subchapter S Corporation, C-Corporation, etc. Do you know the differences?

Selecting the right franchise attorney for your new franchise is crucial in helping determine the legal rights and liabilities as a business owner.

Available for protection

Nobody embarks on a new business venture expecting to fail. However, unforeseen circumstances (see: Covid-19) are always right around the corner. Selecting the right franchise lawyer means having the right team by your side if things happen to go south, for a variety of reasons.

About Drumm Law

At Drumm Law, we understand that today’s law firms are inefficient and outdated. That’s why, as a virtual law firm, we’re proud to offer franchisors and potential franchisees expert services in the area of franchising and Franchise Disclosure Documents.

Learn more about our franchise lawyers or contact us for more information.

What is a Franchise Disclosure Document (FDD)?

Being an educated franchisee (or franchisor) means gathering all relevant information needed before making a solid business decision. And when it comes to the process of sorting through franchising opportunities for your business (or potentially becoming a franchisee yourself), one of the most critical pieces is the Franchise Disclosure Document, or FDD.

A Franchise Disclosure Document, in the simplest of terms, is a legal document that must be given to individuals that are interested in buying a U.S.-based franchise as part of the pre-sale “due diligence” process. The Federal Trade Commission (FTC) created these guidelines in 1978 that required franchisors to share information prior to allowing a new franchisee to join their business.

What does a compliant FDD entail?

A compliant Franchise Disclosure Document consists of over 23 items that are critical to beginning the franchising process, providing information on a variety of areas such as franchise history and background, costs, fees, etc. Some of the more specific areas of a compliant FDD include:

- Business Experience

- Litigation

- Estimated Initial Investment

- Territories

- Financial Statements

- And more…

You need a franchise lawyer

While a Franchise Disclosure Document may seem relatively straightforward, it’s always important that potential franchisors (or franchisees) have a franchise agreement lawyer review the Franchise Disclosure Document before any agreements are made.

“The Franchise Disclosure Document is the document that a franchise is required to have,” said Mike Drumm, attorney and founder of Drumm Law. “We will work to primarily create that for franchisors, and will help update the FDD every year. We will also review (the FDD) for potential franchisees.”

About Drumm Law

At Drumm Law, we understand that today’s law firms are inefficient and outdated. That’s why, as a virtual law firm, we’re proud to offer franchisors and potential franchisees expert services in the area of franchising and Franchise Disclosure Documents.

Learn more about how Drumm Law’s franchise lawyers can help with your franchising processes.

You can read more about what an FDD is in our Franchise Education Section here: What’s an FDD?

How to Legally Play Music in Your Restaurant

So…you own a restaurant (or any business open to the public) and want to play music at your location. Maybe it’s live concerts with local bands. Maybe you just want the ambiance of having something on in the background day to day. To liberally paraphrase Lesley Gore’s 1963 hit, “It’s my restaurant and I’ll jam if I want to!” Unfortunately, this is not a “just press play” situation, so before you start up It’s My Party for your customers, you may want to read on.

Sure, you can listen to whatever tickles your fancy at 8am alone in the restaurant, but if you are going to be playing music in the presence of patrons, it’s time to add another license to your file.

Licenses

Music is governed under Federal Copyright law. The Copyright Act grants five rights to a copyright owner:

- the right to reproduce the copyrighted work;

- the right to prepare derivative works based upon the work;

- the right to distribute copies of the work to the public;

- the right to perform the copyrighted work publicly; and

- the right to display the copyrighted work publicly

For purposes of this blog, we are focusing on number 4: the “performance” aspect, or, in this case, the performing of copyrighted music at your restaurant. Now before you get up on a table with that microphone…

What is a performance?

According to the US Copyright Act, “to “perform” a work means to recite, render, play, dance, or act it, either directly or by means of any device or process or, in the case of a motion picture or other audiovisual work, to show its images in any sequence or to make the sounds accompanying it audible.”

I’m sorry, what now?

In layman’s terms: a performance is playing music in a public setting (i.e. the restaurant).

This means there are two common types of performances you’ll need to consider here: playing pre-recorded music and hosting live music.

Let’s start with playing pre-recorded music. That means Spotify, Pandora, Apple Music, YouTube, your iTunes library on shuffle, vinyl records, CDs, 8-tracks, cassettes, a collage of cell phone videos from that summer you followed Widespread Panic on tour.

Did you say no streaming?

Yep. You probably have your own Spotify or Apple Music account and can Bluetooth or plug into your restaurant’s speaker system, right?

Not so fast.

Well what about playing vinyl records or CDs that I own? I paid for them. Why can’t I play them? They are mine.

Negative Ghost rider, the pattern is full.

While you may own the physical media or pay for the music service, the rights that come with this payment are non-commercial. You can rock out in your car or with your air pods but when you start playing this music for the public, you are now entering the realm of “performance” (air guitar optional).

Streaming services like Spotify, Apple music, Google Play, and Pandora are designed for consumer use and are not fully licensed for commercial purposes. Same goes for that $10 CD you bought. They are for personal use only and do not include a “performance” license, therefore playing them in a commercial setting violates copyright law.

Does that mean we all have to eat and drink in silence?

Not at all. If you want to play music in your restaurant, you have three options.

Option 1: obtain a commercial license from one - or multiple - Performing Rights Organizations (PROs) and play music that you legally own (CDs, vinyl records, digital downloads, etc.)

Okay… what is a PRO?

Great question. Musicians, composers, and songwriters create music and own the intellectual property thereof. PROs exist to protect all that IP and ensure that the artists get paid for its use. Musicians can only sign up with one PRO - the three main ones are American Society of Composers, Authors and Publishers (ASCAP), Broadcast Music, Inc. (BMI) and SESAC. These PROs protect the rights of the artists by selling and enforcing licensing of music in establishments like your restaurant.

You may have already received a nice letter threatening death and destruction from one or more PRO(s) for not having their yearly license. Something like this:

Dear Restaurant Owner,

My name is PERSON and I’m your BMI territory representative.

Every effort has been made to resolve your BMI license amicably, but without success. Because we’ve been contacting you in an attempt to reach a timely and amicable resolve for the music license at your business, RESTAURANT NAME is currently being considered for Copyright Infringement action. It is important that you understand BMI exists to help businesses and other organizations that use music to comply with US Copyright Law in an easy and cost-effective way.

It is very important that I hear from you today.

The cost of using music without permission can be very high. Each musical composition used without authorization entitles the copyright owners to damages between $750 and $30,000, plus attorney's fees and costs. The amount awarded is at the discretion of the judge, who can grant an award as high as $150,000 per infringement, if the court determines the infringement to have been willful.

Please contact me at your earliest convenience to secure the required copyright permission licensing for your business.

Thank you for your prompt attention,

PERSON

If you decide to go with this option, you will either have to obtain licenses from all three PROs or only play music from the catalogue of the PRO with whom you hold a license. Licensing fees are based on the occupancy of your restaurant and can add up in a hurry.

This leads us to the more popular (and cost-effective)

Option 2: sign up for a commercial streaming service that includes the commercial licenses. Think of it as a fancier Spotify. These services run between $25 and $27 a month and include full commercial licensing on a full catalogue of songs, making this option indubitably cheaper than licensing from the PROs. Pandora Business and Sirius XM Business are two popular options.

Don’t like the sound of those numbers? There is one final possibility.

Option 3: play the good ol’ fashioned radio… so long as you meet certain requirements.

If you want to play your favorite local radio station, you must have the “right” size building and the “right” number of speakers. Under the US Copyright Act, a restaurant is eligible for the exemption if it either (1) has less than 3,750 gross square feet of space (in measuring the space, the amount of space used for customer parking only is always excludable); or (2) has 3,750 gross square feet of space or more and (2) uses no more than 6 loudspeakers of which not more than 4 loudspeakers are located in any 1 room or adjoining outdoor space.

When considering these options, it may be worthwhile to also look at your event schedule.

What if I have live bands?

As a host of live music, you (the venue) are responsible for the licensing fees of the songs played in your establishment. A Pandora Business or Sirius XM account does not cover (and there is, unfortunately, no equivalent for) live music. You will have to go with a PRO option.

“But hold on,” you say, “I’m not hiring famous bands for my restaurant. I only work with local artists. Surely, I don’t need a license for that.”

Well, we hate to disappoint, but even local bands sign up with PROs (and don’t call me Shirley). The above-listed organizations have no scope requirements when it comes to membership (although SESAC is invitation-only) and even small-time performers wishing to protect their music can apply. The second issue here is that your local band may perform cover songs. PROs cover the songwriter, not the performer, so if you have a completely original set that finishes with Freebird, you’re still looking at a copyright violation.

Therefore, if you want to have live music and do not want to pay for PRO licensing, you’ll have to:

(1.) Have the band grant you a public performance license for its songs; and

(2.) Have the band agree to only play their music (no covers). Remember that you (the venue) are ultimately responsible for complying with copyright law and proper licensing so it’s important that they (the band) understand that you are on the hook if they decide to play Freebird after all.

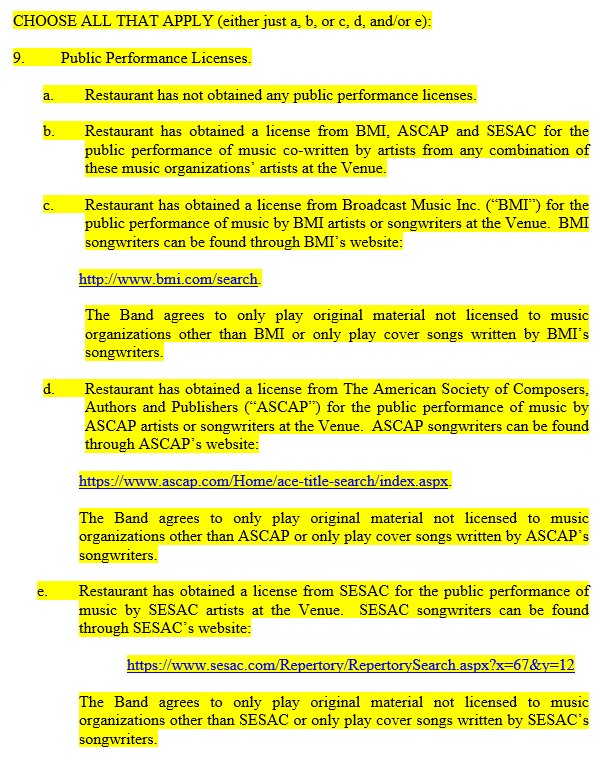

Three PRO licenses for one show? Can I just get one?

Sure. If you don’t want to give up on covers entirely, but don’t want to pony up for all three licenses either, you can settle on just one. You’ll just have to work with the band to select only cover songs licensed by that PRO. Ultimately, the decision of which PRO or PROs to buy licenses from may factor into how frequently you host live music and vice versa.

We have a Live Music Agreement template available to restaurants at no charge. All you have to do is ask. Our template lets you choose which PRO license you have, if any, and provides links to each PRO database so bands can pre-screen cover songs:

Our agreement also includes a limited public performance license grant for the band’s original material.

Our agreement also includes a limited public performance license grant for the band’s original material.

I haven’t done any of this and it’s been fine so far. What if I keep doing what I’m doing?

Harassment from the PROs. Bad karma. Oh… and fines exist. Remember the BMI letter above? “Between $750 and $30,000.” Is Freebird really worth $30k?

Questions? Feel free to contact us. We’re happy to discuss your options in more detail and help you figure out the best way for your business to be in compliance.

10 Work From Home Tips to Increase Productivity

Drumm Law and its team of 24 have been working remotely for 10 years. Here are some tips for the newly virtual.

- Get out of bed (literally and figuratively)

Do not lay in bed with the laptop. That is fine for weekend/evening work but not for day to day. Get out of your pajamas. There is a psychological component (for me at least) about getting dressed and ready for work and working. - Setup a work area

Ideally, you need a separate place, whether it is a guest room, separate office or basement. If you have younger kids, a room with a door lock can help (my kids would randomly show up in the middle of a conference call before I had installed a lock on the door and two year olds rarely leave quietly). If you do not have access to a separate work area, use technology to create a “virtual work area.” Noise cancelling headphones are key! (I recommend either the Bose QC 35 or Bose QC 700)This commercial sums up why I love my noise cancelling headphones when I work from home:

https://www.youtube.com/watch?v=VqYK9W2A53s - Set up a workstation

Your laptop may have worked for weekend work but will it work for your daily workload? Do you need a bigger monitor? Are you a dual monitor addict? Set yourself up to be productive. Have everything you need in one place. - Set a work schedule

Avoid the “Am I always at home or am I always working” mentality by planning each day (this is also a productivity hack too). Set your work day and breaks. It’s okay if it changes. - Communicate with your family

Let them know your break schedules. Have them treat you like you are at work (text me as opposed to coming into my work area). - Stay away from the fridge

You are in a new “work” environment with new “work” food. Limit your snack visits to avoid the Virtual Freshman 15. - People should only know you are working from home if you tell them

Don’t have dogs barking in the background or the television on. This may also tie back to communication with the family. Let them know if you have an important call or if they need to be extra quiet. - Be careful of scammers

They are also working from home. Make sure you have anti-virus protection. Don’t open emails that look suspicious. Now might be a good time to update passwords. - Get work done

It’s easy to get distracted with news, social media and life. Try to be as productive as you can. Don’t put off work unless you have to. Try to do “business as usual” as much as you can. - Take breaks

Do you normally take a lunch break every day? If so, continue to do it. Use the time you would have spent commuting to the office each day to take a walk or exercise.

How to Effectively Sell Your Franchise Business

So, you are thinking of selling your business, or part of your business. Congratulations! Now, take a seat and roll up your sleeves. There is hard work and tears ahead (and not just for your attorney).

A few years ago, my husband and I sold our house. But before we could put it on the market, our agent told us to get to work. We went through every drawer and every closet, removed anything offensive (don’t ask) and organized every square inch. Then, we had the plumber look at the leaky sink, replaced the roof, and fixed all the creaky doors. Our agent then walked through our house and told us to replace the window coverings and remove all personal items. Our agent told us it was easier to fix and clean-up before the potential buyer was insisting on it. Then, and only then were we ready for prospects.

You should treat the sale of your business in the same way. This process takes time, and doesn’t tend to be very fun. But the work you do before you actually sell your business is the best way for you to preserve the value of your company. I’ve broken this down in more detail below.

Tip #1: Clean House Before You Go to Market. Most of my clients do a great job of spiffing up their storefronts, but they tend to ignore the back office. In my experience, it is the mess in the back office that Buyers most often use as an excuse to ask for a discounted purchase price. For example, if you are a franchisor, do you have complete records showing that you have followed the sales disclosure regulations for each of your franchise sales? If not, Buyer’s counsel will often argue that Buyer will need to discount the price (or possibly defer payment of part of the purchase price) because of the risks that Buyer has learned about.

So, what is the best way to clean house? I start by sending my clients a standard due diligence checklist. This is the document that most Buyers use to request information from their Seller once the sales process begins. I highlight the items that I would anticipate will be the highest priority for a Buyer of Seller’s company and ask my clients to prepare their files for each item. If any information is missing or is not in order, we can often resolve it if we have the time and space to fix it ahead of time. If Buyer is the one who finds an oopsie in the files, we don’t usually have the option to fix it.

If you are considering selling your business in the near future, reach out to us. We’re happy to have a brief discussion with you about the process, and to send you a due diligence checklist for you to use to start cleaning house. Then we can have your business looking clean and bright, and lessen the chance for Buyer asking for a discount.

Tip #2: Hire (and use) your Professionals. We know you are the expert at running your business. But you may not have the same expertise in the business of buying and selling companies, which is a specialty all its own. Generally, we recommend that you work with a corporate attorney, an accountant, and possibly a broker and/or a financial consultant.

Timing is also an issue. Many sellers wait to bring in professionals until later in the process (hoping to save money). You can actually save money if you bring professionals into the process early on. We would recommend involving your professionals before you even go to market. For example, I’m often brought on board after a Letter of Intent (LOI) has been signed. Often, this means that we are trying to negotiate legal protections later in the process which were unintentionally given away in the LOI.

You’ll also want to consider each of the protections you need during the process. For example, your attorney should prepare a “deal-specific non-compete” early on in the process, and provide guidance on what types of information you should disclose before a purchase agreement is signed. Bringing on professionals early on in the process will help protect the confidentiality of your business, and make sure that you don’t give away benefits of the sale that could decrease the value of your business.

Tip #3: Know your Buyer. You found a Buyer! Life is good! Is there anything else you need to worry about? Unfortunately, this is an area that many Sellers tend to ignore. As much as companies want to sell their company and then move on, selling the company is not the end of the road for Sellers. Most purchase agreements contain various ongoing issues: a portion of the purchase price may be deferred, Seller may end up agreeing to finance a portion of the purchase price, the lease or other third party agreements may be assumed, etc. This means that even after the business is sold, the Buyer and the Seller are still riding off into the sunset together to some extent.

So, what should you be doing as the Seller? We recommend that a minimum you do some research on the financial strength of your Buyer. We would recommend that you start by researching the type of information that is publicly available online, including a UCC search and search for other industry-specific financial information, like audited financials in an FDD (if the Buyer is a franchisor).

Finally, you may want to consider researching more of the soft-side information. Is the Buyer reliable? Well-respected in its industry? Does the Buyer have a similar corporate culture as your company? Being discriminating on your Buyer will help avoid going down an expensive and time-consuming negotiation path with the wrong buyer. It will also help you confirm that the Buyer will have the ability to pay your purchase price.